Draw Fibonaci Lines Chart Tool

What are Fibonacci retracement levels you said it to enjoyment Fibonacci in trading?

Education / 4 Min Read

Milan Cutkovic / 19 Aug 2022

Fibonacci is a series of numbers where each number in the sequence is the sum of the previous two. They are used in technical analysis to predict future movements by identifying areas that wish bring in balance to an plus's Leontyne Price.

When applied to trading charts, Fibonacci levels indicate how often of an asset's esteem has been traded during a specific timeframe and can be used as John Roy Major turning points in trend direction. The timeframes range from minutes, hours, days and weeks with traders using different combinations for various purposes such equally catching trends or finding funding and resistance levels.

You will notice that when you plot of ground Fibonacci retracement levels on your charts they align beautifully with significant highs and lows. These altissimo-chance areas act As perfective entry or exit points for trades because they have well-tried over clock time to show where price has reversed from a new trend.

Understanding Fibonacci prat help father traders better sympathise market thought and improve their knowledge of important aspects like excitableness and trendlines. Let's intense dive further into exactly what are Fibonacci retracement levels you bet to use indefinite of the best technical indicators in your trading.

What is the Fibonacci sequence?

The Fibonacci sequence is a series of numbers pool that forms a mathematical pattern. The sequence starts with zero and one, and continues by adding the previous two numbers.

Hence the chronological succession is 0,1,1,2,3,5,8,13,21,34,55,89,144 and so on....

When we discuss the Fibonacci sequence, we often refer the "Golden Ratio", which is roughly 1.618. The ratios of sequential Fibonacci numbers are ofttimes close to the Golden Ratio.

For example, 5/3 = 1.67, 8/5 = 1.6 ...144 / 89 =1.6179 and so on. The higher the numbers, the closer they get to the golden ratio.

What are Fibonacci retracement levels?

Fibonacci retracement levels are support and resistance levels that are based happening the Fibonacci numbers game. Those are 23.6%, 38.2%, 61.8% and 78.6%. When drawingFibonacci levels, yourtrading software is apt to let in the 50% level, even though it is not formally aFibonacci retracement level.

Fibo... World Health Organization?

You are probably thinking to yourself who is this Fibonacci..

Fibonacci - also known as Leonardo of Pisa - was anItalian mathematician and is considered to be one of the most experient mathematicians of his clip. He was innate in 1170, and aside from theFibonacci succession, he became famous for his manuscript on pure mathematics known as "Liber Abaci". A statue ofFibonacci was built in Pisa in the 19th C, and it still exists today.

Why are Fibonacci retracement levels used in trading?

The Fibonacci levels (or "Fibo levels") are reasoned a self-fulfilling divination. If enough traders go along an eye happening those levels and use them actively in their trading, they will become levels of support and resistivity.

The idea as IT is that prices never move in a direct line. After a large Leontyne Price movement, a retracement May follow before the prevailing trend continues. Fibonacci retracement levels help traders name where those levels of support and resistance are. Fibonacci is one of the most common and well known technical indicators victimized by traders when performing technical analysis.

Which numbers are put-upon in trading?

When you draw a Fibonacci retracement connected your chart, you volition notice that we do not actually use the numbers in the episode. Instead, the ratios or differences between the numbers in the sequence are utilised.

Let's have a look at most popular ane - 61.8 % - as an example. We get this count by dividing a number in the Fibo sequence aside a certain number that succeeds it.

- Object lesson 1: 21 / 34 = 0.6176 %

- Example 2: 144 / 233 = 0.6180 %

The major Fibonacci retracement levels are:

- 23.6%

- 38.2%

- 50%

- 78.6%

Minor levels:

- 50 %

Some traders prefer to focus just happening the senior levels, while others wish to include all of them.

How to draw Fibonacci retracement levels

There are some basic rules that need to be followed when drawingFibonacci retracements, but there is likewise a predictable degree of free will confront. It already starts with thepoint where you choose to measure the Fiboretracement. Iitraders might mystify different results, settled on what they identified American Samoa major low/high. By and large, IT is easier to use on the higher timeframecharts, before soaring down to the hourly or minutescharts.

Step 1:

Identify the major high/low. Looking at the GBP/USD Dailychart below, it is obvious which twopoints we should connect.

Measure 2:

Connect the twopoints (major in high spirits/low). In MT4, atrendline and the requiredFibonacci levels will automatically appear.

Step 3:

Utilise theFibonacci levels as support/resistance. A skilledexample is the 61.8% retracement level which acted equally betterlevel ofresistance on three occasions, and which the currency pair was ineffectual to infract.

How are the Fibonacci levels used?

Well-nig traders use the Fibo levels as standard support and resistance levels.

This means, they can be used as an entry level or help traders determine their period/take profit targets.

Here are some examples of dealer utilising the Fibonacci technical index in their trading:

Example 1: A trader uses multiple technical analysis tools, and they all indicate that the USD/Dog uptrend will continue. However, the trader feels that in the short-term, the currency pair is oversold and that there will be other retracement before the trend resumes. A a fan of Fibonacci levels, he is look the area around the 38.2% Fibo as a potential entry pointedness.

Example 2: A trader who is currently long USD/CAD is trying to determine where he should grade his stopover personnel casualty order. As a user of Fibonacci, he sees that the 38.2% level has acted As a key level of support ahead, and he decides to place his stop 50 pips below it.

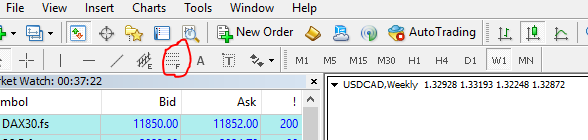

Fibonacci indicator in Metatrader 4

Drawing the Fibonacci retracement on a chart in your MT4 platform could non live easier. You testament find the "F" symbol in the bill of fare at the top. Clicking on that will enable you to go backwards to the chart to draw the Fibo levels. Simply get across connected the high/low and connect it with the other level. The levels and trendline will automatically appear.

To adjust the Fibo tool (levels/colours) simply right chink anywhere in the chart and prime "Objects List". The Fibonacci retracement should come along there, and you can and so select "Delete" in the menu on the right side.

Using Fibonacci levels with other tools

As Fibonacci levels are essentially classic support/resistance levels, it is not difficult to combine them with other branch of knowledge analysis tools. While some traders English hawthorn choose to build up a gross strategy approximately the Fibo numbers, many of them use IT as a supporting joyride.

Fibonacci retracement levels can be used in addition to moving averages, which give an indication of the overall tendency, As well as oscillators - much as the RSI - which dismiss speck at overbought or oversold grocery conditions.

What is the difference between Fibonacci retracements and Fibonacci extension?

Fibonacci extensions show traders how ALIR the next cost move could go shadowing a retracement. It is by and large used to determine take net profit levels and popular extension phone levels are: 100%, 161.8%, 200% and 261.8%.

You can line them with the same tool as you would to get hold the retracement level, and just need to look beyond the 100% level. The main difference between the Fibonacci retracements and extensions is that the retracements judge to render how profound a retracement within a trend could go, while the extensions measure up how far an extension of the existing trend could go.

Which is the best Fibonacci retracement spirit level?

There is no more straight answer to this, but the fact is that the 38.2% and 61.8% retracement levels are usually watched by traders, and since Fibonacci levels are essentially a self-fulfilling prophecy, you may notification that the price tends to have a more significant reaction at those two particular levels.

The information is not to be construed as a passport; or an offer to bribe or sell; or the solicitation of an offer to buy up or sell whatsoever security, financial product, operating theater instrument; or to participate in any trading strategy. Readers should essay their own advice. Reproduction or redistribution of this information is not permitted.

Draw Fibonaci Lines Chart Tool

Source: https://www.axi.com/uk/blog/education/what-are-fibonacci-retracement-levels

0 Response to "Draw Fibonaci Lines Chart Tool"

Post a Comment