Can a Limited Partnership Have Only One Partner

What is a limited partnership?

A limited partnership is a partnership in which there are two types of partners: general and limited partners. General partners manage the business and are jointly liable for the debts and obligations of the business. Express partners have express liability for business concern debts and obligations just don't actively manage the business organization.

When starting a small business, your option of concern entity is one of the well-nigh important decisions to brand. The decision tin be especially complicated if you go into business with multiple partners or programme on acquiring investors. The express partnership, recognized in all 50 states, is a variation of a regular partnership.

Learn more near how limited partnerships piece of work, how they compare to other types of partnerships and how to form a limited partnership in your state.

How limited partnerships piece of work

A partnership is a business that is owned past two or more individuals, who each contribute something of value to the company, such as money, holding, skills or labor. Partners share in the profits and losses of the company. All of this remains true in a express partnership, but a limited partnership has two different types of partners: general and limited partners.

Full general partners participate in the day-to-solar day direction of the business concern. Each general partner faces total personal liability for the debts, obligations and activities of the partnership. This ways if someone has a legal claim confronting the partnership, they can sue any or all general partners. They tin even lay merits to the full general partners' personal assets if the business assets of the partnership aren't sufficient.

Every bit their name suggests, limited partners play a much more than express office in the business. Limited partners are oftentimes called " passive investors " or "silent partners." They typically contribute money to the business and share in the income stream of the business. Withal, they don't participate in the twenty-four hours-to-day management of the company. And similar shareholders in a corporation, express partners are only liable for business debts and obligations up to the extent of their investment in the company. In other words, if a express partner invests $1 million in the business concern, that'southward the maximum they tin be personally answerable for in a lawsuit confronting the company.

When are limited partnerships useful?

Limited partnerships are not every bit popular amidst pocket-sized-business organization owners equally some other business entity types, peculiarly LLCs and S-corporations. However, there are special instances in which they are common.

Here are some situations where limited partnerships are mutual:

-

Family unit businesses: Many family-owned businesses designate 1 or two members of the family every bit general partners with management responsibility. The other family unit members are express partners, sharing only in the income of the business. Eventually, direction responsibility passes on to younger family members who inherit the business. This is sometimes called a family limited partnership.

-

Commercial real estate projects: A limited partner ofttimes fronts money for large commercial real estate projects, such as shopping malls and apartment complexes. The limited partner receives fiscal benefit from the income generated by the project, just they designate a full general partner to oversee the completion of the projection itself.

-

Professional businesses: In professional person industries, such as doctor's offices and constabulary firms, older, retiring members might wish to stay involved as express partners. They'll cede direction control of the company to full general partners.

-

Estate planning: A limited partnership can exist used as an estate planning tool, where the general partner holds real estate on behalf of the heir. The nugget produces an income stream for the heir, who volition somewhen hold the real estate in their own right.

In the examples mentioned to a higher place, the ability to pool the resources of full general and express partners tin exist critical to getting the business off the basis. General partners bring skills and labor to the table, while express partners bring financial resources.

Fifty-fifty Warren Buffet started out with a limited partnership called Buffet Associates Ltd. The company included vii of his family unit members and friends. Buffet was the full general partner and put in just $100 of his own money. His family unit and friends were express partners and contributed a sizable initial investment. With his investing prowess, Cafe grew the group's initial investment of $105,000 to $105 million in assets within 13 years!

Limited partnership taxes

Limited partnerships are pretty similar to general partnerships when information technology comes to taxes. A express partnership is a pass-through entity, which means the partnership itself doesn't pay taxes in the manner a corporation would. The partnership fills out Form 1065 every bit an informational return and provides a Schedule One thousand-1 to each partner with details of the partner's share of the company's income and losses. Using the Schedule K-1, each partner then reports their share of the business income and losses on their personal tax return. The income is taxed at the owner'due south personal income tax charge per unit.

If business losses are greater than profits, partners in a limited partnership can deduct losses upwards to their investment in the businesses. If their losses are greater than their investments, they tin carry the losses to other years to kickoff the profitability of those years. Simply since limited partners don't participate in the management of the business, their income is called passive income or loss. Passive income or losses can only offset other passive income.

I tax advantage of limited partnerships is that just full general partners have to pay self-employment taxes on their earnings from the visitor. Self-employment taxes cover Social Security and Medicare taxes. Limited partners don't take to pay self-employment taxes (except on guaranteed payments received for services provided to the partnership) because they don't participate in the day-to-day management of the concern.

Limited partnership compliance

Since limited partnerships accept investors, they are bailiwick to many of the aforementioned securities laws as corporations. Issuing ownership shares in a express partnership, chosen limited partnership units, is similar to issuing stock in an Due south-corporation or C-corporation. Simply like corporations, express partnerships must hold investor meetings and allow all partners access to business books and financial records. Some states even require limited partnerships to publish an annual study.

The best dominion of thumb is to empathise your land's laws and requirements as well as possible. Every country, except Louisiana, has enacted some version of the Uniform Limited Partnership Human action .

Other types of partnerships

There are several different kinds of partnerships. The main affair partnerships have in common is that multiple people own the business, and they all share in the profits and losses of the business organisation. However, each type of partnership is very different in terms of management structure and the division of resources and liability. Limited partnerships accept 2 kinds of partners: general and limited partners. General partners are exposed to personal liability, but manage the business concern on a daily ground. Limited partners invest money in the business organisation and are shielded from personal liability beyond the corporeality of their investments. However, limited partners don't participate in daily management of the visitor.

General partnership

A general partnership is 1 of the simplest types of concern entities to start. In fact, if you start a business concern with multiple owners and don't register your visitor with the state, your business organisation is a full general partnership past default.

In a general partnership, all the owners share in the management responsibilities, profits and losses. Each owner is also fully personally liable for the debts and obligations of the business. Each partner owes fiduciary duties of loyalty, care and skilful religion to the partnership and other partners.

Articulation venture

A joint venture is a temporary full general partnership that two or more people or companies showtime for a particular purpose. Normally, a joint venture expires when the project is completed or on a specific appointment, then it is more than limited in scope than a general partnership.

Like to a full general partnership, the parties to a joint venture are personally liable for the debts and obligations of the business concern and owe a fiduciary duty to one some other. A joint venture might also exist launched as a split LLC or corporate entity, in which case partnership rules wouldn't apply.

Limited liability partnership

A limited liability partnership (LLP) has no general partners. In this type of business organisation, all partners take express personal liability for the debts and obligations of the business. LLPs are popular among professionals, like doctors and architects. In fact, in some states, the LLP construction is simply available to professionals. Professionals like to class LLPS then that they can actively participate in the business organization just aren't personally liable for malpractice claims filed against their colleagues.

Limited liability express partnership

In that location is yet another type of partnership chosen limited liability limited partnership (LLLP) that'due south simply recognized in some states. An LLLP is similar to a limited partnership because it has general and limited partners. Withal, the large difference is that the general partners take express personal liability for the partnership'southward debts and obligations. That ways if the partnership is sued, all partners are responsible only upwardly to the amount of their investment. LLLPs are popular amid groups of real estate developers, who seek to limit their exposure to what they've invested in a project.

Pros and cons

It's best to get the aid of a business chaser and tax professional person when making this decision, simply these are some pros and cons to consider.

Pros

-

Puddle resources: This structure allows you lot to puddle the financial resources of express partners, combined with the skills and labor of full general partners.

-

Limited liability for limited partners: Limited partners tin't face up liability beyond what they invest in the business concern.

-

Full general partners are independent: Full general partners tin can make management decisions, without having to consult express partners.

-

Easy transitions: Limited partners can easily exit the business without causing management problems.

-

Unproblematic revenue enhancement filing: Limited partnerships have simple laissez passer-through tax filing, where each partner reports their share of the business income and losses on their personal tax render.

-

Works for some business types: Certain types of businesses, like family-owned businesses and existent estate companies, prefer limited partnerships.

Cons

-

General partners face up more than liability: Full general partners face maximum personal exposure for business debts and obligations.

-

No say for express partners: Express partners have no say in business decisions, which tin cause tension among partners.

-

More paperwork: Limited partnerships require more paperwork and compliance than a general partnership.

In most cases, forming a limited partnership comes downwards to resource constraints and practicality. Someone might have a keen concern idea and the skills to make that thought a reality, simply lack the cash to go started. If that person can find a express partner to front the greenbacks in exchange for a portion of the business profits, then a limited partnership is born. The express partner is shielded from liability, and the general partner agrees to take on more risk.

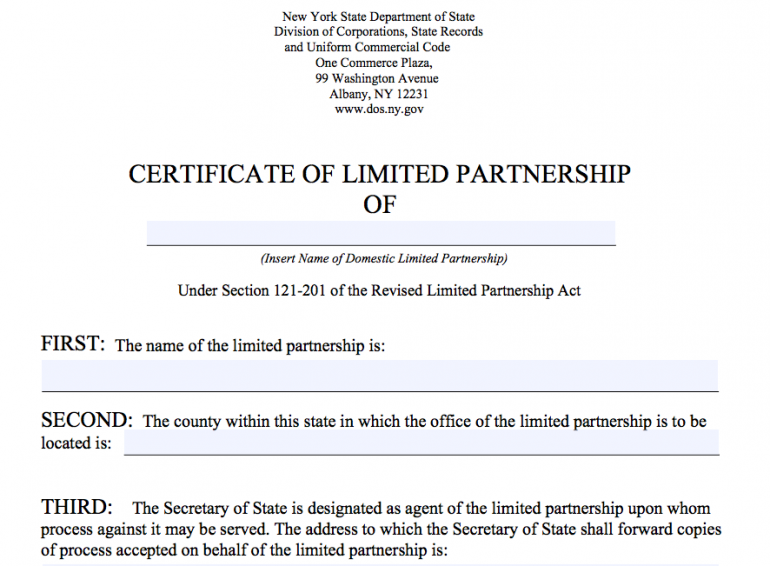

Source: New York Department of State

How to form a limited partnership

If you make up one's mind that you want to form a limited partnership, then you'll have to file a certificate of limited partnership with your state'due south secretary of land office. The certificate of limited partnership contains the following basic data near your visitor:

-

Name of the business concern (typically must end in "Limited" or "Ltd.").

-

Registered agent of the business concern who volition accept legal documents on the business concern's behalf.

-

Proper noun and accost of each general partner.

-

Signature of general partner or person filling out the form.

Before long after filing your Certificate of Limited Partnership, you and your partners should typhoon a partnership agreement. An agreement is non legally required, and it'due south not filed with the state. Nonetheless, a partnership agreement is a very important document because information technology provides a pattern for operating your business. The agreement lays out the rights and responsibilities of each partner, stemming conflicts in the future.

Business owners who want some help in filing their Document of Limited Partnership might desire to try a service like LegalZoom. LegalZoom has a footstep-by-step questionnaire to make filing the class a breeze. It volition also help yous create a custom partnership agreement.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

boothegrapinglies.blogspot.com

Source: https://www.nerdwallet.com/article/small-business/what-is-a-limited-partnership

0 Response to "Can a Limited Partnership Have Only One Partner"

Post a Comment